Instructions. This take-home exam will be due on

Wednesday, October 8 at 10:20 am. The exam is worth 100 points.

Answer all the questions. You may use your text, notes, and if necessary a

calculus textbook. You MAY NOT consult

with any of your classmates or use any sources other than those enumerated

above. Show all of your work and BE

NEAT. You should have more than sufficient time to prepare a careful , neat exam

to hand in, I will most intolerant of

messy, disorganized work. Be sure to write out and sign the Honor Code on your

exam, an unpledged exam will incur

an automatic 20 pt. penalty. If you have any questions, feel free to contact me.

If I am not in my office or on campus,

call me at home at 410-871-9580. Good luck!

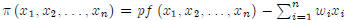

[10 pts.] 1. Profit Function

Consider the profit function . Prove that a

sufficient

. Prove that a

sufficient

condition for concavity of the profit function is concavity of the production

function .

[25 pts.] 2. Labor/Leisure Choices

In previous utility-maximizing situations, we have assumed that money income is

exogenous. In the real world ,

however, this is not the case. For more individuals, their income is at least in

part a function of how much they

work. That is,

where  represents non-wage income, w the wage

rate, and L hours worked, the quantity wL represents labor

represents non-wage income, w the wage

rate, and L hours worked, the quantity wL represents labor

income. The household budget constraint is thus

For this to be a non-trivial problem, we must incorporate labor decisions into

the utility function. Suppose that our

utility function was additively separable in consumption and labor, that is we

could write U(x, L) = u(x)+v(L),

where u is well-behaved (i.e. is concave) and v has properties v < 0, v' < 0,

v'' < 0. The intuition here is that

having to work gives an individual disutility and that the marginal disutility

of work is increasing.

(a) Write down the Lagrangian for this problem and take the first- order

conditions .

(b) Totally differentiate the first -order conditions and use Cramer’s rule to

find the comparative statics

derivatives  and

and

. If possible, sign these derivatives.

. If possible, sign these derivatives.

(c) Redo part (b), only now you are looking for

and

and  . If

possible, sign these derivatives.

. If

possible, sign these derivatives.

(d) If u(x) = θ log x and v (L) = -L2/2, solve this system for the

optimal quantities x* and L*: [HINT:

You will find the quadratic formula helpful. Recall that the quadratic formula

tells us that the roots to the

second-degree polynomial ay 2 + by + c are ]

]

(e) You know that x* is a demand function. Provide an analogous interpretation

for L* .

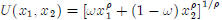

[15 pts.] 3. Constant Elasticity of Substitution Utility

Consider the utility function  (ρ and ω

are constant parameters).

(ρ and ω

are constant parameters).

(a) This is a special preference specification called the constant elasticity of

substitution (CES) utility function.

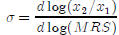

The elasticity of substitution is defined as:  ,

it measures the curvature of an indifference

,

it measures the curvature of an indifference

curve. Verify that the elasticity of substitution is indeed constant for this

utility function. Use the following

steps :

(i) Find the Marginal Rate of Substitution for this utility function. Recall

that  . The

. The

MRS should be a function of the ratio  .

.

(ii) Take logs and differentiate , do note be confused by the notatation. If we

let  and

and

log(MRS) = w, you are deriving dv/dw:

(b) Write down an appropriate budget constraint, form a

Lagrangian, and solve for the demand functions.

[25 pts.] 4. Profit Maximization

Do problem 14 from Chapter 4 of the Silberberg and Suen text. You may skip parts

(c), (f), (h) and (i).

[25 pts.] 5. Monopoly and Elasticities

Consider a monopolist that faces the inverse demand curve p(y): If the

monopolist’s cost function is denoted

c(y), its profit function is:

π(y) = p(y)y - c(y).

(a) Take the first- and second- order conditions for the monopoly problem.

(b) The monopoly price is can be expressed as:

p(y) = g(y)MC(y),

where MC denotes marginal cost and g(y) > 1 it the markup over marginal cost.

Use the first-order

condition to show that the markup is a function of the elasticity of demand,

.

.

(c) Show that the markup is constant for the isoelastic demand function y = Apb

(d) Using your answers to (b) and (c), explain in math and in English why a

monopolist will always produce at

a point such that the demand for its good or service is elastic. [HINT: Show

what happens to total revenue

if output falls and demand is inelastic.]